Circle of Competence: A True Investment Strategy

“If knowledge is power, knowing what we don't know is wisdom.”

- Adam Grant

Have you ever felt overwhelmed by the vast amount of information and knowledge available? Perhaps you've found yourself eagerly reaching out to understand and absorb everything within your grasp. On the way a realization hits - " to be Jack of all trades is to be Master of none". Meaning that, trying to be knowledgeable in every area can lead to being average in all of them. This familiar sentiment captures the essence of a concept known as the 'Circle of Competence'.

Join me in exploring the circle of competence as an effective investment strategy. We'll uncover its meaning, understand its significance, and learn how it can improve our investment decisions. Let's discover the key to smarter investing together.

Circle Of Competence

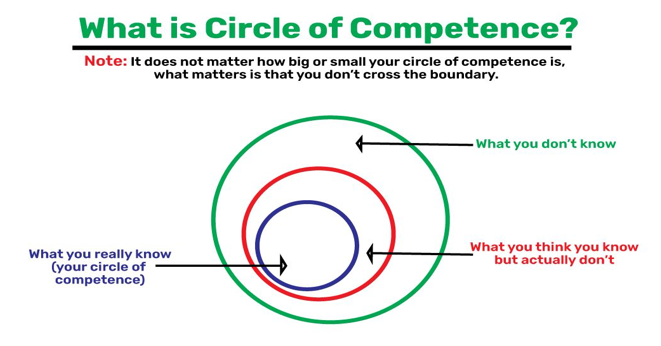

In this visual representation, we have three different circles illustrating different levels of knowledge and competence. The outermost circle represents the vast expanse of information that lie beyond our current understanding. As we move inward, we encounter a smaller circle that represents our perceived knowledge, but upon closer examination, we realize that the reality is different. Finally, at the core, we find the smallest circle, symbolizing our true areas of expertise where we possess genuine competency.

In this visual representation, we have three different circles illustrating different levels of knowledge and competence. The outermost circle represents the vast expanse of information that lie beyond our current understanding. As we move inward, we encounter a smaller circle that represents our perceived knowledge, but upon closer examination, we realize that the reality is different. Finally, at the core, we find the smallest circle, symbolizing our true areas of expertise where we possess genuine competency.

The Circle of Competence is a concept that involves recognizing and differentiating what you know and what you don't and focusing on those areas where you can have an edge simply because you understand them better. Your Circle of Competence consists of the areas where you have a deep understanding, knowledge, and expertise that give you an advantage over others.

We all have a basic understanding of how certain businesses operate, for instance a hotel. We know that you need a space, invest in its setup, hire staff, and attract customers to make a profit. This knowledge allows us to evaluate and invest in similar businesses. However, when it comes to industries like automobile or insurance, our understanding is often limited. The inner workings and details of these industries require specialized knowledge and skill. So, while we can grasp the fundamentals of some businesses, comprehending the complexities of other industries can be more challenging. Hence, the circle of competence can be termed as the right spot where you need to hit the nail with the hammer in hand to have better accuracy.

Why is it valuable to establish and stay within your Circle of Competence?

See, the thing is, we are timebound and expected to make the most out of what we are given. Therefore, first and foremost, we should try to answer the question: 'Where should we invest our time to achieve most?'

To make the most of our limited time, it is rational to invest our time in areas where we are competent and have a natural advantage. By operating within our Circle of Competence, we position ourselves for better results and an edge over others. This deliberate focus allows us to leverage our knowledge and skills, maximizing the potential for success and achieving optimal outcomes.

While venturing into unfamiliar territory can lead to disastrous outcomes, playing to our strengths and focusing on what we know best can minimize the risk of failures and costly mistakes. Furthermore, staying within the circle equips us with the temperament needed to navigate turbulent markets. Volatile market conditions can test even the most seasoned investors, but when we have a strong foundation in our chosen domain, we can remain composed and make rational decisions. Our knowledge and experience provide us with the confidence and stability necessary to withstand market fluctuations and stay on track toward our investment goals.

Let’s put this in the words of Charlie Munger:

"The whole trick of the game is to have a few times when you know something is better than average, and invest only where you have that extra knowledge. If that gets you a few opportunities, that's enough."

How to define your Circle?

Discovering our Circle of Competence involves a process of self-reflection and exploration. We must begin by assessing our skills, knowledge, and experiences to identify areas where we possess a deep understanding and confidence. We can consider our professional background, educational qualifications, and any specialized training we have received. Seeking feedback from others who have observed our performance in different arenas might also help.

Imagine a doctor working in a pharmaceutical company has a deep understanding of the industry dynamics, regulatory requirements, and products, giving him an edge when investing in pharmaceutical businesses. This expertise becomes his Circle of Competence.

However, if this doctor were to venture into the airline industry without a clear understanding of how it operates, he would likely underperform compared to others who possess relevant expertise. Therefore, understanding our background is crucial in defining our Circle of Competence.

The question on whether to stick to what you know or expand your abilities often sparks debate. On one side, people argue that focusing solely on projects within your circle of competence is wise. On the other side, some encourage stepping out of your comfort zone. So, who holds the correct viewpoint?

Instead of seeing this from a complete black or white perspective. Let’s take it gray.

When we are jumping outside the boundary of our circle and wandering around without having a strong foundation, we tend to put our investments at risk. Even a small turbulence in the market can test our temperament. Since, risk is something we are very careful about as a value investor we can agree that it is better to stay within our circle of competence.

But this should not mean that, we should always restrict ourselves from learning new things and gaining new experiences as Warren Buffett suggests:

The size of that circle is not very important; knowing it’s boundaries however, is vital.

Overtime we can expand the size of our circle through knowledge and effort and put ourselves inside the circle where there are more opportunities.

Final Verdict

In conclusion, understanding and staying within our Circle of Competence is a powerful investment strategy. By recognizing our areas of proficiency, we can capitalize on our knowledge and skills, positioning ourselves for better results and an edge over others. Focusing on what we know best minimizes the risk of failures and costly mistakes, while also equipping us with the temperament needed to navigate turbulent markets.

However, it is also important to strike a balance between staying within our Circle of Competence and expanding our knowledge over time. By knowing the boundaries of our expertise and continuously seeking growth, we can broaden our circle and unlock new opportunities for success. Remember, the true value lies in aligning our time and investments with our areas of genuine competency, enabling us to make the most of our limited resources and achieve optimal outcomes.