How the Insurance Sector in Nepal is Evolving?

The insurance sector plays a crucial role in the financial industry, offering individuals and organizations a valuable shield against potential losses. This financial safety net allows people to transfer their worries about unforeseen events in exchange for manageable premium payments. Whether it's protecting life through life insurance, safeguarding valuable assets with property insurance, or ensuring business continuity against unexpected setbacks, the insurance sector serves as a reliable partner. The growth of the insurance sector is crucial for a country's economic stability, risk management, and financial security. So, let's take a closer look at how insurance and the insurance industry have evolved over time in Nepal.

What is Insurance?

A contract between a policyholder and an insurance company to bear uncertainties and risks that may occur due to unfavorable events in exchange for a premium can be regarded as insurance. There are two parties involved; an insurer and the insured where an insurer is a company that helps to cover the financial losses resulting from damage, loss, or theft as mentioned in the insurance policy whereas the insured is the person or a party who pays the regular premiums for the safeguarding of the assets or life in which the party have the insurable interest.

Loss is always a possibility, but insurance can help with that. Insurance collects premiums from different parties and invests in fruitful sectors, which help promote the country's economic development. Insurance involves spreading risk; many policyholders pay premiums, and whenever one has a negative event, the insurance firm makes up the difference from funds collected.

Evolution of the Insurance Sector in Nepal:

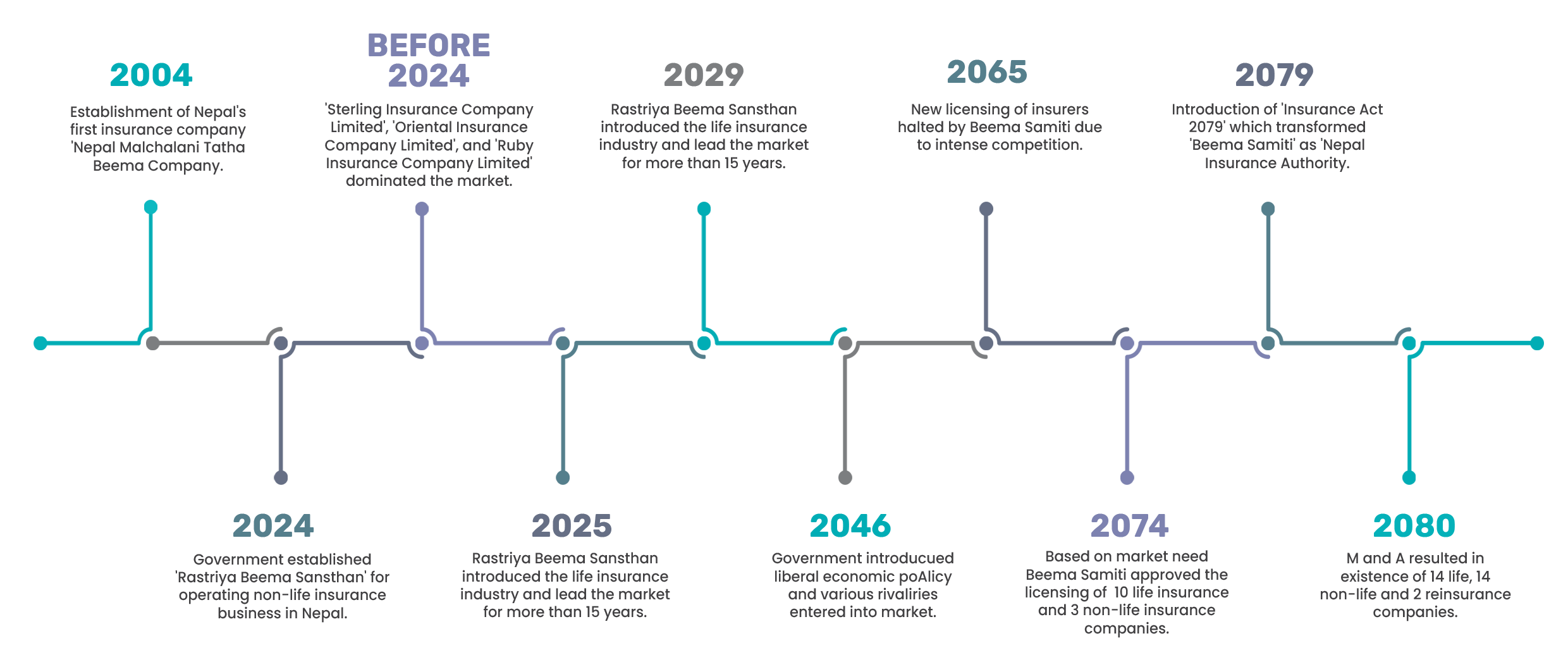

There were no Nepali insurance companies before 2004 B.S., so Nepal Bank Limited, Nepal's first bank, established the first insurance company titled 'Nepal Malchalani Tatha Beema Company'. It became 'Nepal Insurance and Transportation Company Limited' in 2016 B.S. It transformed into 'Nepal Insurance Company Limited' in 2048 B.S. to operate as non-life insurance. Nowadays the company undertakes business by offering a range of non-life insurance products.

Around 2025 B.S., several insurance companies such as Sterling Insurance Company Limited, Oriental Insurance Company Limited, and Ruby Insurance Company Limited (now National Insurance Company) had ruled. On the 1st of Poush 2024, the Nepalese government established 'Rastriya Beema Sansthan' with a capital of one crore, which was only functioning the non-life insurance business in Nepal. The 'Rastriya Beema Sansthan Act 2025' was introduced on the same day the next year for the ongoing operations of its business. Rastriya Beema Sansthan set up the life insurance industry in Nepal on Falgun 7, 2029 B.S, as well as leading the market for more than 15 years.

The modern period of insurance began in Nepal with political developments in 2046 B.S. when the government implemented a liberal economic plan that allowed new rivals to enter the market. National Life Insurance and General Insurance Company were founded in the private sector. Up to 2065 B.S there existed seven life insurers and thirteen non-life insurers. The new licensing process for the registration of new insurance businesses was then halted by Beema Samiti due to intense competition from the regulatory body at the time. Following 2074, the B.S. Beema Samiti accepted the licensing of ten new life insurance firms and three non-life insurance companies based on market demand.

The introduction of Nepal's 'Insurance Act 2079' on Asoj 24, 2079, was a landmark milestone. It included changing the 'Beema Samiti' to 'Nepal Insurance Authority' (Beema Pradikaran), which amplified its regulatory responsibility. The enactment of important regulations included 'one agent, one insurance policy,' greater client protection, and the Risk-Based Capital (RBC) system beginning in 2080/2081. Furthermore, the paid-up capital requirements for life and non-life insurers were increased from 2 Arba and 1 Arba, to 5 Arba and 2.5 Arba respectively.

Current Status of Insurance Business in Nepal:

Current Status of Insurance Business in Nepal:

Nepal had 19 non-life insurance companies, 20 life insurance companies, and 1 reinsurance firm. However, due to mergers, acquisitions, and policy changes, the number of life insurance companies has decreased to 14, non-life insurance companies also 14, and 2 reinsurance companies. According to the Nepal Insurance Authority (NIA), the life insurance business covers 60% of the market based on insurance premiums.

Aside from numerous improvements in the insurance sector, we can examine various issues in the insurance sector. One of the primary issues is insurance accessibility in rural areas of the country; the insurance industry's focus is on the Bagmati province. According to the NIA, Bagmati province accounts for 48.44% of total business in the life and non-life insurance industries. A further challenge is proper insurance business regulation; companies counter that the NIA is too slow in approving new products, which kills innovation in the insurance business.

Emerging Microinsurance in Nepal:

In Nepal, the microinsurance concept is likewise in its early stages. This insurance is targeted at low-income individuals who work in sectors such as raising cattle and farming. The Nepalese government also provides 75% subsidies for these kinds of programs. Guardian Micro Life, Quest Micro, Protective Micro Insurance, and Nepal Micro Insurance started operations and expanded access to insurance in Nepal's rural areas after obtaining approval from the Nepal Insurance Authority.

Trends Shaping Insurance:

The insurance sector is undergoing a digital transformation that is being driven by technologies such as blockchain and generative AI. These advancements provide benefits such as cost reductions, enhanced risk assessment, and improved customer service. However, their implementation requires infrastructural expenditures along with addressing ethical and legal issues. Implementing solvency guidelines and catastrophic funds, along with sound risk management, is vital for long-term industry stability and public confidence in Nepal.

Conclusion:

In summary, Nepal's insurance sector is expanding rapidly, with 41.15% engagement, rising 13.64% from the previous year. To sustain this achievement, the Nepal Insurance Authority (NIA) is essential in oversight and regulation, including fraud prevention and public confidence fostering growth. Long-term stability depends on implementing solvency and capital adequacy regulations and implementing effective risk management techniques, which requires collaboration between regulatory bodies, insurers, and consumer groups. Educated consumers and customer-driven insurers contribute to a healthy industry, ultimately encouraging Nepal's economic stability and progress.