The Highlights of Budget 2080-2081

As the country grapples with an ongoing economic slowdown, everyone eagerly awaited this year budget announcement. This budget is government's official plan to address the current economic challenges and stimulate growth. The 2023 Budget is a highly significant event in the country's financial calendar, attracting keen interest from diverse stakeholders, including businesses, investors, and all the citizens.

The budget provides the government with an opportunity to outline its priorities and plans for the next financial year, considering factors such as economic growth, tax revenue, and expenditure requirements. The Economic Survey, published on 28th May before the budget, presents an overview of the previous year's economic performance and outlines the government's stance on economic policies.

Did the budget adequately tackle the current pressing issues faced by Nepal, such as low government revenue and expenditure, unemployment, inflation, slow economic growth, education quality, poverty, and various recent protests?

Let's get started. here are the key highlights of the 2023 Budget of Nepal:

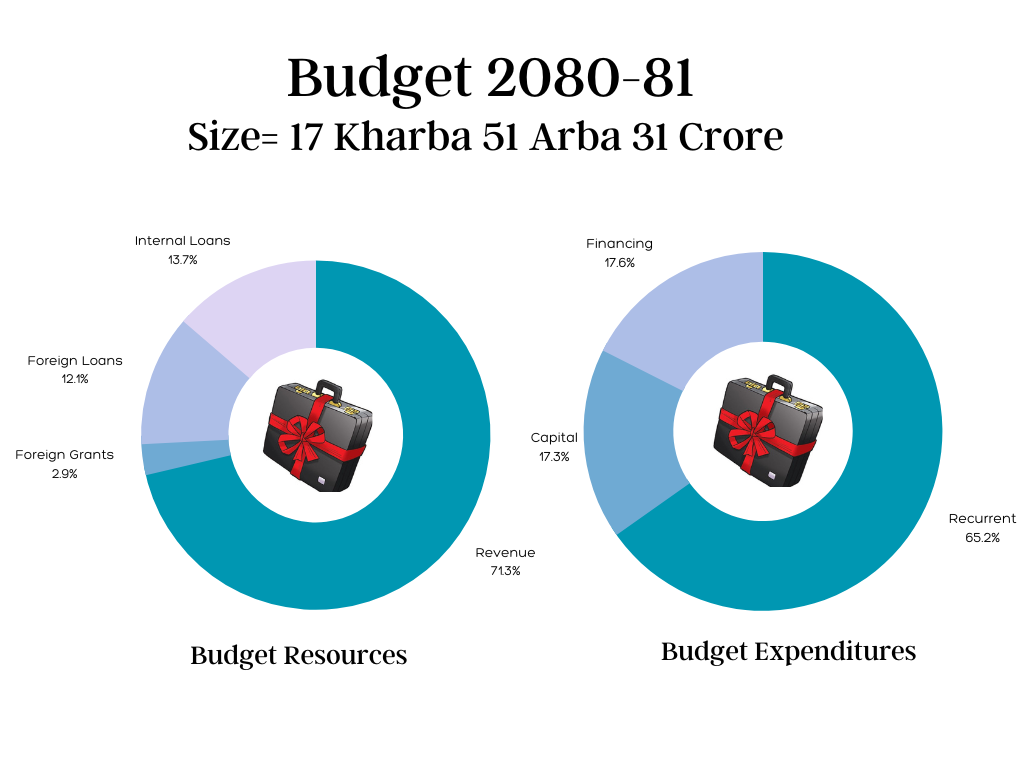

Nepal Government has allocated NRs. 17 Kharba 51 Arba 31 Crore as budget for fiscal year 2080-81. A significant portion of the budget, amounting to Rs. 11 Kharba 41 Arba 78 Crore (65.20%), has been allocated for recurrent expenditure. The budget allocates Rs. 3 Kharba 2 Arba 7 Crore (17.25%) for capital expenditure and Rs. 3 Kharba 7 Arba 45 Crore (17.55%) for financial management. Tax revenue is estimated to contribute Rs. 12.48 Kharba, foreign aid will cover Rs. 49.94 Arba, foreign loans will provide Rs. 2.12 Kharba, and internal loans will contribute Rs. 2.40 Kharba to the budget.

Cost Reduction Initiative:

Cost Reduction Initiative:

- A decision was taken to reduce expenses by eliminating incentives and allowances, refraining from purchasing new vehicles or furniture, and prioritizing only essential purchases.

- In the next fiscal year 2080/81, the government will not buy new vehicles. Instead, they will auction off unused vehicles and goods within six months.

- Fuel facilities for government officials will be provided in cash, pending approval from relevant authorities.

- Plans to shut down 20 unnecessary government offices, development committees, projects, trusts, and departments.

- Foreign trips will only be undertaken when deemed necessary, and there will be no creation of additional positions.

Agriculture Receives a Massive Benefit:

- Agricultural grants will be allocated in accordance with the level of agricultural production.

- The Prime Minister Agriculture Modernization Project has been allocated a budget of Rs 3 Arba 22 Crore.

- The promotion of indigenous native crop production will be prioritized.

- A budget of Rs 30 Arba has been dedicated to providing grants for the purchase of chemical fertilizers.

- A sum of Rs 1 Arba 20 Crore has been allocated to support and encourage youth and startup initiatives in the agricultural sector.

- The cultivation of marijuana will be taken into consideration for its medicinal applications.

Innovation, Investment and Start Up:

- A minimum of 1 percent of the annual budget will be allocated towards fostering innovation, invention, and research.

- The promotion of "Make in Nepal" and "Made in Nepal" initiatives will be prioritized.

- The budget prioritizes VC and PE investments in SMEs, aiming to support their growth and vital role in the economy.

- Prioritized a favorable environment for venture capital and private equity investors, with the budget offering incentives to promote economic diversification and job creation in SMEs.

- Companies can register with an initial paid-up capital of only Rs. 100, without extra fees for increasing capital. The government will facilitate online registration and suspension, boosting convenience for businesses.

- To promote a startup ecosystem, the Government of Nepal has allocated significant budget of 1 Arab and 25 crore rupees.

Land and Co-operatives

- The restriction on land plotting, which has been in place for the past few years, will be lifted to promote the real estate sector.

- The operational scope of saving and credit cooperatives will be restricted to specific geographic areas, and a dedicated regulatory body will be established to ensure proper supervision and regulation of these institutions.

Labor, Employment and Social Security

- The Prime Minister Employment Program has been allocated a budget of Rs 5 Arba 94 Crore.

- Initiatives will be taken to promote entrepreneurship among individuals who have returned from foreign employment in Nepal.

- Additional foreign employment destinations will be identified and utilized to maximize employment opportunities.

- The promotion of a contribution-based social security program will be prioritized.

Financial Sector

- The promotion of online banking, mobile banking, QR code technology, and the adoption of the latest banking technologies will be prioritized and facilitate easy financial access for SMEs.

- The amendment of banking acts will be pursued to modernize the financial sector and establish a robust regulatory system.

- Efforts will be made to promote financial access and implement the restructuring of government-owned banks to strengthen their operations and enhance their effectiveness.

- The continuation of providing an additional 1% interest rate on remittance accounts will be implemented to encourage the flow of remittances through the banking channel.

- Remittance bonds will be issued to promote and facilitate the inflow of remittances.

- The concept of social banking will be actively pursued, along with the promotion of microfinance, to enhance financial access in rural areas. The establishment of the Sana Kishan Udham Program will be extended to all local levels through Sana Kishan Lagubitta Sanstha.

Capital Market

- The promotion of institutional investors in the capital market will be encouraged.

- Promoting NRN’s participation in capital markets, specifically through investing in listed hydro power and real sector companies.

- Promoting the expansion and diversification of financial instruments, aiming to increase the range of options and enhance opportunities within the market.

- The amendment of existing acts related to the capital market will be prioritized to strengthen and expedite its functioning.

- The operation of a commodity exchange market and a dedicated platform for SMEs will be initiated.

Key Tax Highlights

- Those earning over Rs. 50 lakhs annually are subject to a 39% tax rate.

- High-end goods and services are subjected to a 2% luxury tax.

- Luxury hotels and resorts are required to pay a luxury tax.

- Nepali individuals traveling abroad for tourism purposes are obligated to pay a 5% tourist tax.

- Manpower companies facilitating foreign employment are liable to pay a 1% fee.

- A 3% education service tax is applicable on foreign currency exchange for studying abroad, which was previously 2%.

- Non-Nepali firms offering digital services will be required to pay a 2% digital service tax.

- E-commerce operators will be subject to a 1% advance tax imposition.

In conclusion, the 2023 Budget of Nepal carries several significant highlights aimed at addressing the prevailing economic challenges and promoting growth. The government has taken measures to reduce expenses, eliminate unnecessary offices, and prioritize essential purchases, showcasing a commitment to fiscal discipline. The 2023 Budget of Nepal presents a combination of initiatives, with some reflecting a repetition of past budgetary measures, while others are tailored to address present economic considerations. However, the true strength and impact of this budget will only be realized through the comprehensive and effective implementation of its provisions.