What is Short Selling in Stock Market?

Have you ever imagined making money even when stock prices are falling?

Picture this: you've conducted extensive research on a specific company and discovered that its stock is overvalued. With anticipation that the stock price will decline, you're eager to capitalize on this opportunity. That's where short selling enters the scene.

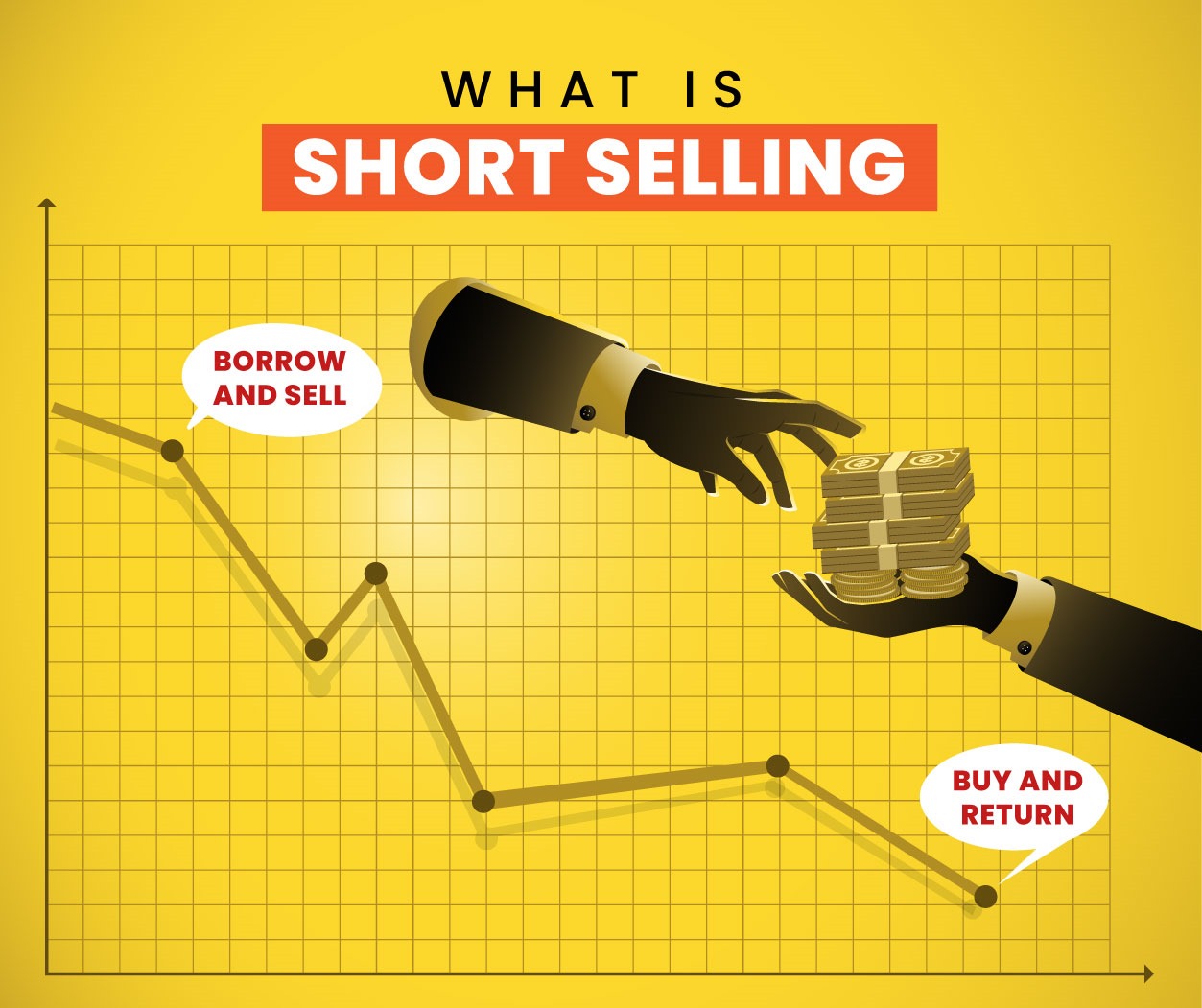

Short selling allows investors to profit from declining stock prices by borrowing shares, selling them at the current market price, and later repurchasing them at a lower price to return to the lender, thus earning the difference as profit.

So, if you've ever wondered how to make money when stocks are on the downturn, short selling could be the answer.

Let’s learn about Short Selling with simple example:

Suppose Mr. Ram believes that the share price of Company X is overvalued and anticipates a price drop. He approaches his broker and requests to borrow 100 shares of Company X for a specified period. Once he secures the shares, he promptly sells them at the current market price, let's say at Rs. 500 per share, totaling Rs. 50,000.

Now, Mr. Ram patiently waits for the anticipated price decline. As expected, the share price of Company X declines from Rs. 500 to Rs. 400 per share. At this point, Mr. Ram seizes the opportunity and repurchases the 100 shares of Company X at the reduced price, spending Rs. 40,000. He then returns the 100 shares to his broker as per their agreement.

In this scenario, Mr. Ram initially borrowed and sold the shares when they were valued at Rs. 50,000, and later repurchased them at Rs. 40,000, resulting in a profit of Rs. 10,000. This exemplifies how short selling enables investors like Mr. Ram to profit from downward movements in stock prices.

Now, we have a clearer understanding of the concept of short selling, where investors borrow shares they don't own with the aim of profiting from a decrease in their price. But is short selling really as simple as it seems?

Let's delve into its merits and demerits to find out.

Merits of Short Selling:

Profit from Falling Prices: Short selling allows investors to make a profit from the decline in the price of a share. This can be a good opportunity for traders to make money even though the share prices are falling.

Flexibility in Trading: Short selling offers flexibility in trading strategies, allowing investors to profit from both upward and downward price movements in the market.

Price Discovery: Short selling contributes to price discovery in the market by providing liquidity and enabling the efficient pricing of securities. It helps to incorporate bearish sentiment into the market, ensuring that prices reflect all available information, both positive and negative.

Demerits of Short Selling:

Risk of Price Increase: While short selling offers opportunities for investors to profit from declining stock prices, it also carries inherent risks, one of which is the potential for unexpected price increases. This risk arises when the market value of the shorted stocks rises instead of falls, leading to losses for the short seller.

Margin calls: When investors engage in short selling, they borrow shares from a broker, essentially taking as a loan. If the market price of the borrowed shares increases rapidly, the investor may receive a margin call from the broker. This call demands that the investor deposit additional funds or securities into their account to meet the increased margin requirements. Failure to fulfill a margin call can lead to forced liquidation of the short positions. Thus, margin calls add a layer of risk and financial pressure to the practice of short selling.

Market Manipulation: Short selling can be used to manipulate stock prices, particularly when combined with spreading false information or rumors to drive down share prices. This manipulation can harm other investors and disrupt market stability.

Traders' Negative Mindset: When all the big players start to enforce short selling, it may lead to a drop in the market price of the share rapidly, and small investors can face huge losses.

Why do Some Countries Permit and Others Ban Short Selling?

Regulations governing short selling vary significantly between developed, developing and emerging markets, influenced by factors like the maturity of the financial market, the strength of regulatory institutions, and the overall economic landscape. While some countries permit short selling under stringent regulations, others opt to ban the practice entirely. In the United States, short selling is legal and strongly overseen by the Securities and Exchange Commission (SEC).

Conversely, countries like South Korea prohibit short selling altogether, while in places like China, short selling faces heavy regulation and may be temporarily restricted during market turbulence. Malaysia permits short selling but enforces strict regulations and temporary bans during market downturns.

Overall, overseeing the regulation of short selling is a complex task, requiring a thorough examination of its potential pros and cons. While short selling can aid market efficiency by providing liquidity and enabling risk mitigation for investors, it also carries the risk of worsening market declines and facilitating manipulation. Therefore, regulators must carefully balance the promotion of market efficiency with the protection of investors and the stability of the financial system.

Short Selling in NEPSE:

Unfortunately, short selling is not available in the Nepal stock exchange due to the reasons discussed above, which include the necessity for strong regulation and a mature financial market. Nepal, being a developing country, lacks established securities exchanges, financial expertise, and a mature financial system. The legal frameworks and operational infrastructure required for implementing short selling are not fully developed in our country.

Similarly, even countries with more advanced financial systems than ours may struggle to fully regulate short selling and implement temporary bans as needed. However, as Nepal's financial market continues to evolve, regulations regarding short selling may be subject to change by regulatory body. Yet, any changes will depend on various factors unique to the country's economic and regulatory landscape.

Conclusion:

In summary, short selling offers traders the opportunity to profit from falling stock prices, but it also comes with significant risks. While it can provide liquidity and aid in price discovery, it may lead to market manipulation and instability if not regulated properly. Regulatory frameworks vary between countries, with some permitting short selling under strict rules, while others ban it altogether. In Nepal, short selling is not available due to the country's developing financial market and regulatory infrastructure. As the financial market evolves, there may be changes in regulations, but careful consideration of the potential risks and benefits is crucial. Overall, short selling remains a complex strategy that requires careful consideration and adherence to regulations to ensure market stability and investor protection.